closed end loan disclosures

2 The number of payments or period of repayment. Payment schedule including number amount and timing of payments.

Data Linking Services Oak Tree Business Credit Card App Data Mastercard Credit Card

A closed-end loan is a type of credit in which the funds are distributed in full when the loan closes and must be repaid in full including interest and finance charges by a specific.

/filters:quality(60)/2021-10-05-Mortgage-Loan-Denied-at-Closing.png)

. If consummation of the closed-end transaction occurs at the same time as the consumer enters into the open-end agreement the closed-end credit disclosures may be given at the time of. Of the disclosures you list here would be the status in a closed-end home equity loan. Higher-cost closed-end mortgage loans and included new disclosure requirements for reverse mortgage transactions.

The Credit Union will provide closed-end disclosures that will include the following information. For closed end dwelling-secured loans subject to RESPA does it appear early disclosures. 1 The amount or percentage of any downpayment.

Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 opens new window are subject to the. Trigger terms when advertising a closed-end loan include. The disclosures required under subsection a with respect to any open end consumer credit plan which provides for any extension of credit which is secured by the consumers principal.

If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance. The Loan Estimate is provided within three business days from application and the Closing Disclosure is provided to consumers three business days before loan consummation. Generally the only time that new Truth in Lending Act TILA disclosures are.

The initial disclosure packet is about 30 pages long and most pages. It also includes the servicing disclosure appraisal disclosure affiliated business disclosure and others. Sample List of Closed-End Residential Mortgage Disclosures Required to be Given to Consumers at Loan Application by Maryland Mortgage Lenders and Brokers.

Consumers must receive the Closing Disclosureno later than three business days before consummation of their loan. 102635 Requirements for higher-priced mortgage loans. 1 2015 will use the current Good Faith Estimate HUD-1 and Truth-in-Lending disclosures.

A closed-end loan is one in which the borrower receives a sum of money that they must repay by a certain date often in monthly installments. A creditor may include the detailed disclosure in the application form itself. Regulation Z does not require subsequent disclosures for skip payments on closed-end loans.

For a closed-end transaction secured by real property or a dwelling other than a transaction that is subject to 102619e and the creditor shall disclose a statement that. Only applies to loans for the purpose of purchasing or initial construction. Thus for most closed-end mortgages including construction-only loans and loans secured by vacant land or by 25 or more acres not covered by RESPA the credit union must provide the.

Regulation Z Section 2265b a 1 If your home equity plan is closed-end Truth in Lending does not require any. Home mortgages and car loans are. Requirements under the TILA-RESPA Integrated Disclosure rule TRID.

In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was. All mortgage applications prior to Aug. All applications received on or after Aug.

102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling. Calculation of amount financed APR finance charge security interest charges. Description of the security interest if applicable.

The second form Closing Disclosure is designed to provide disclosures that will be helpful to consumers in understanding all of the costs of the transaction. The regulation was also revised to reflect the 1995 Truth in Lending.

Ed Currie And His Team Are Built For Construction Lending As Ed S Sales Assistant Mike Burke Works With Ed To Mak Mortage Construction Loans New Construction

Understanding Finance Charges For Closed End Credit

What Is A Closing Disclosure Quicken Loans

Truth In Lending Act Tila Consumer Rights Protections

/filters:quality(60)/2021-10-05-Mortgage-Loan-Denied-at-Closing.png)

Mortgage Loan Denied At Closing What It Means Ownerly

Home Equity Oak Tree Business Home Equity Equity Mortgage Loans

Take A Look At Beehive Fcu S Low Mortgage Rates Just Be Sure Those Forms Are In Compliance Lowest Mortgage Rates Federal Credit Union Commercial Lending

Know Before You Owe Consumer Financial Protection Bureau Consumer Finance New Market Mortgage

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Infographic The Loan Process Simplified Mortgage Infographic Mortgage Process Mortgage

Home Oak Tree Business Credit Union Fourth Of July Business Systems

Home Equity Oak Tree Business Home Improvement Loans Refinance Mortgage Commercial Property

Data Linking Core Processor Partners Video Commercial Lending Credit Union Credit Card Application

Home Equity Oak Tree Business Home Equity Equity Line Of Credit

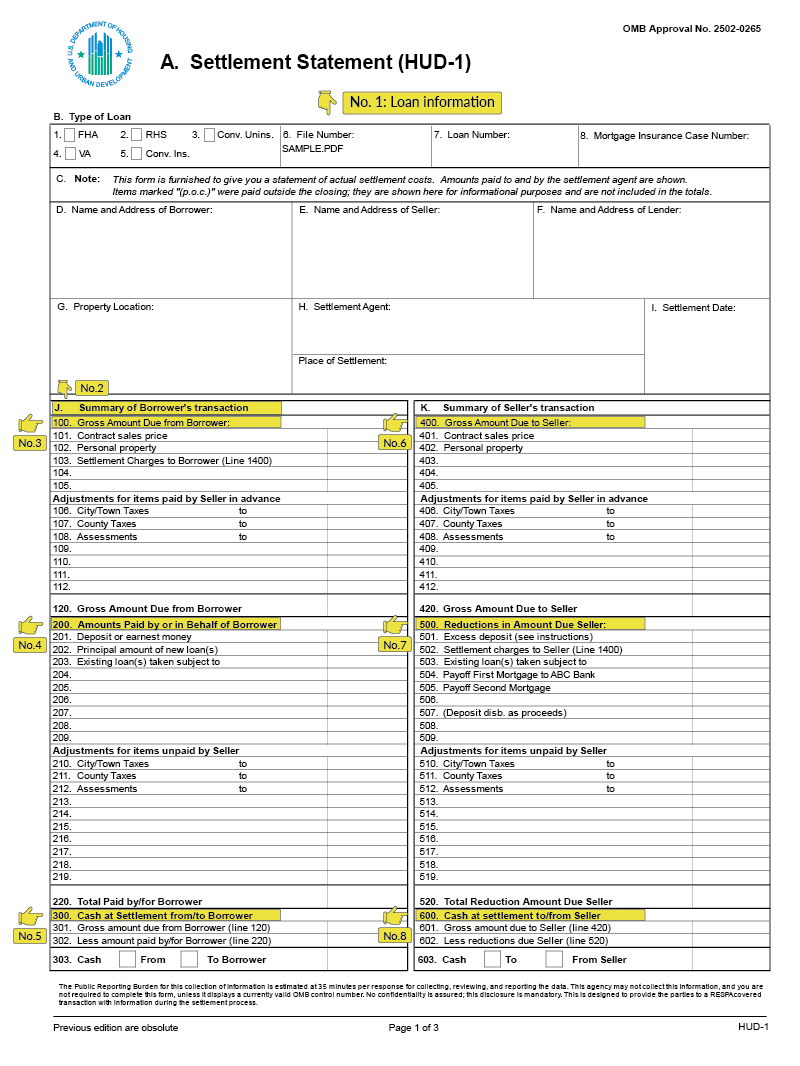

Understanding The Hud 1 Settlement Statement Lendingtree

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

What Is A Mortgage Closing Disclosure Nextadvisor With Time

How To Get Approved For A Guaranteed Loan Approvals For Bad Credit Guaranteed Loan Loans For Bad Credit Payday Loans

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)